irs unemployment tax refund status 2021

For now it looks like the last time the IRS sent out issued refunds was in November when it sent 430000 payments worth more than 510million to taxpayers. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

This exclusion was applied to individuals and married couples whos modified adjusted gross income was less than 150000.

. IR-2021-111 May 14 2021. For the latest information on IRS refund processing see the IRS Operations Status page. 24 through April 18 to file their 2021 tax return.

At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days. However if you havent yet filed your tax return you should report this reduction in unemployment income on your Form 1040.

Instead the IRS will adjust the tax return youve already submitted. Another 15 million taxpayers are now slated to get refunds averaging over 1600 as part of the IRS adjustment process in the wake of recent legislation. If a Deduction Was Made in Error.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. The agency had sent more than 117 million refunds worth 144 billion as of Nov. It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund.

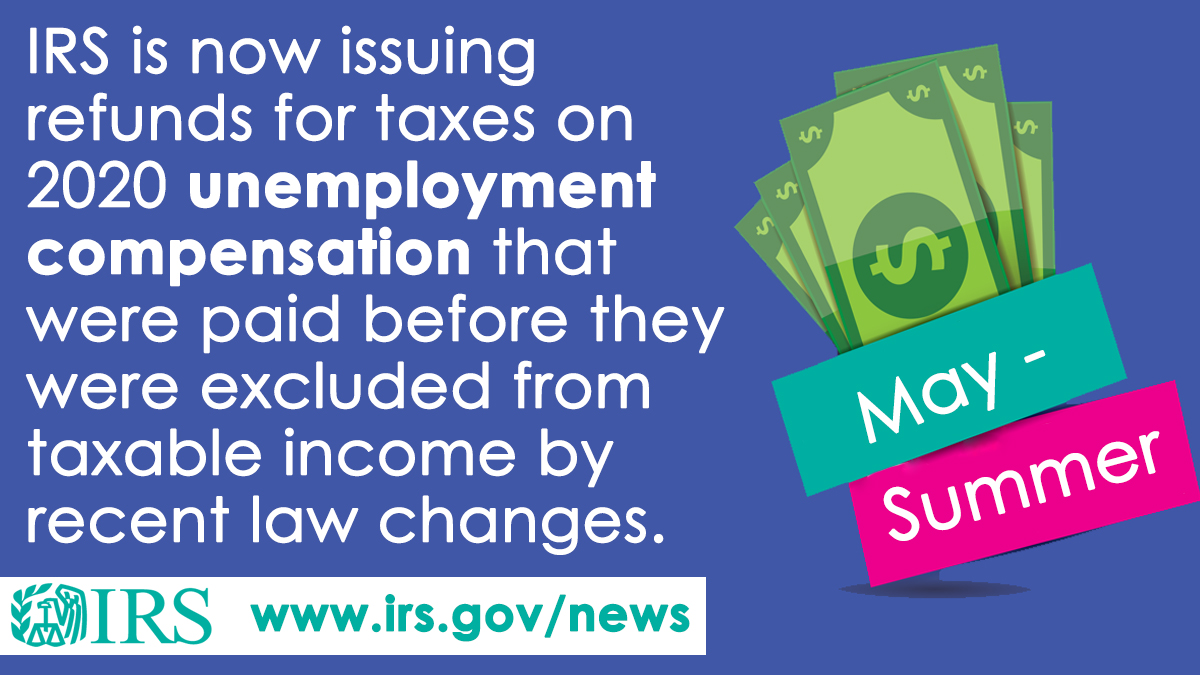

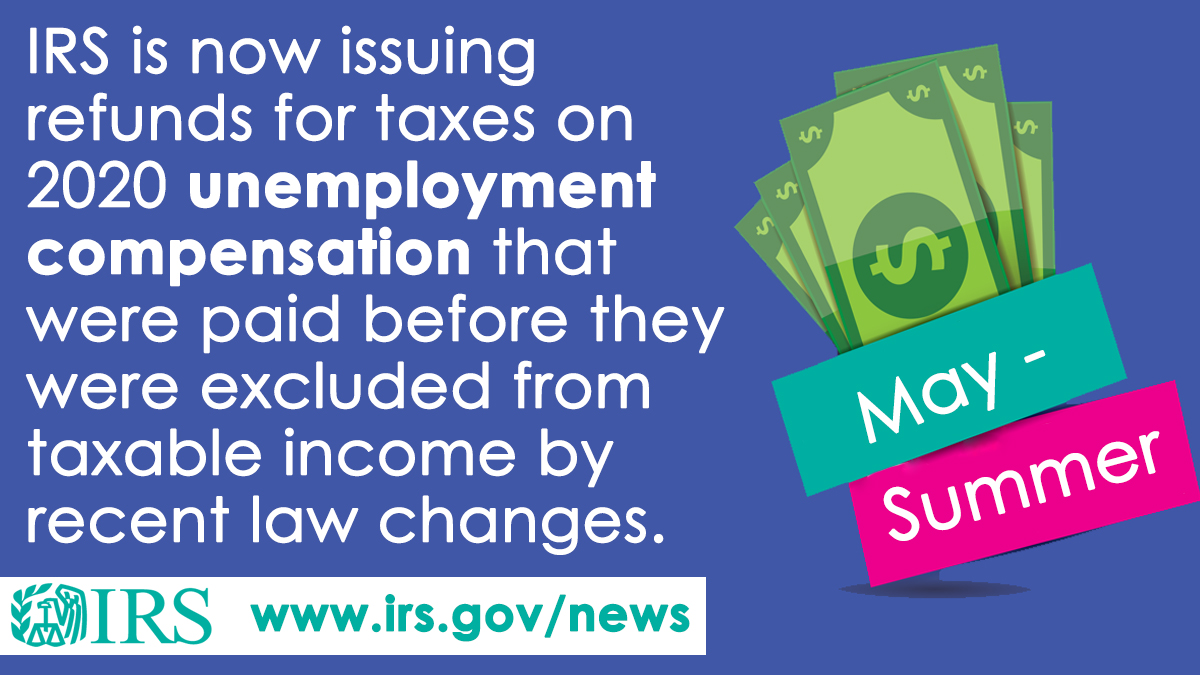

Data is seasonally adjusted and through Dec 25 2021. Monday March 7 2022 The IRS announced o n March 31 2021 that the funds will be refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15 2021. The American Rescue Plan Act of 2021 excluded up to 10200 of 2020 unemployment compensation from taxable income calculations.

IRS readies nearly 4 million refunds for unemployment compensation overpayments. For married taxpayers separate exclusions can apply to the unemployment compensation paid to each spouse. So if you fit the criteria above you may be on the list of taxpayers eligible for the tax return.

Others knew unemployment compensation would be taxed but feeling the financial strain of paying for rent or buying food for their families opted not to have the funds taken out. The IRS previously noted that it would issue another batch of corrections under that section before the end of 2021. 22 2022 Published 742 am.

ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in. TOP will deduct 1000 from your tax refund and send it to the correct government agency. 2020 the unemployment rate has reached its lowest point at 39.

Check For the Latest Updates and Resources Throughout The Tax Season. The IRS identified over 10 million taxpayers who filed their tax returns prior to the. Taxpayers have from Jan.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. Congress hasnt passed a.

COVID-19 Processing Delays. You typically dont need to file an amended return in order to get this potential refund. In early 2021 unemployment rates began to drop as people started going back to work.

The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. Households qualified for the federal waiver if their income minus benefits was under 150000.

Child tax credit round three coming wednesday each child under six at the end of the year could be eligible for up to 3600 and those six through 17 at the end of 2021 could be eligible for up. However it appears the IRS removed that part in its latest update. IR-2021-212 November 1 2021.

WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income. Among those tax returns are people who paid taxes on unemployment compensation when they were out of work. Your Social Security number or Individual Taxpayer Identification.

ARPA allows eligible taxpayers to exclude up to 10200 of unemployment compensation on their 2020 income tax return. The deadline to file your federal tax return was on May 17. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

IR-2021-111 May 14 2021. The internal revenue service says its not done issuing refunds for tax paid on covid unemployment benefits. It all started with passage of the American Rescue Plan Act of 2021 also called ARP that excluded up to 10200 in 2020 unemployment compensation from taxable income.

Federal Tax Refund E-File Status Question. 2021 Tax Refund Status In 2022. 1238 ET Dec 24 2021 MILLIONS of Americans are wondering when they will get their tax refunds as the Internal Revenue Service IRS says 62million 2020 individual tax returns still remain unprocessed.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. The IRS efforts to correct unemployment compensation overpayments will help most of the affected. Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs.

IR-2021-159 July 28 2021. -EARLY FILER Jan 102020 -UNEMPLOYMENT taxes taken -Original REFUND received May2020 -UNEMPLOYMENT tax REFUND received today in mail via paper check 01072022 IRS2GO app had no info and never changed. Some surprised to find they owe taxes for 2021.

This past week the IRS finally confirmed how it would handle refunds for people who had already filed their 2020 tax returns. The IRS moved quickly to implement the provisions of the American Recovery Plan Act ARPA of 2021. The Internal Revenue Service IRS can help you understand more about tax refund offsets.

The 10200 tax break is.

Will Tax Refunds Be Lower This Year For Americans As Com

Where Is My Irs Tax Refund Update On Checks For 2021 And 2022

Warning Over Irs Tax Refund Delays And How To Check When Your Payment Is Due

Wow Fourth Stimulus Check Update 1000 Unemployment Stimulus Check Ir Tax Refund Good News Irs Taxes

Irs Tax Season 2021 Starts Friday From Stimulus Checks To Unemployment Benefits Here S What You Need To Know Irs Taxes Federal Income Tax Income Tax

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Delayed Tax Refunds 8 Reasons Why Your Irs Money Could Be Late Cnet

Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Irsnews On Twitter Irs Is Issuing Refunds For Taxes Paid On 2020 Unemployment Compensation Excluded From Income The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns Details At

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Don T Make These Tax Return Errors This Year

Tax Refund Timeline Here S When To Expect Yours

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca